How To Pay Quarterly Taxes In Nc . employers are required to file the quarterly tax and wage report (form ncui 101) for each quarter, beginning with the quarter in. Schedule payments up to 365 days in advance; Missing a quarterly tax deadline can lead to penalties, but it's not the end of the world. safety measures are in place to protect your tax information. Click here for help if the form does not appear after you click create form. to pay individual estimated income tax: estimated tax payments must be sent to the north carolina department of revenue on a quarterly basis. You are required to pay estimated income tax if the tax shown due on your return, reduced by your north. Here's what to expect and you.

from www.templateroller.com

You are required to pay estimated income tax if the tax shown due on your return, reduced by your north. estimated tax payments must be sent to the north carolina department of revenue on a quarterly basis. Schedule payments up to 365 days in advance; Missing a quarterly tax deadline can lead to penalties, but it's not the end of the world. safety measures are in place to protect your tax information. employers are required to file the quarterly tax and wage report (form ncui 101) for each quarter, beginning with the quarter in. Here's what to expect and you. Click here for help if the form does not appear after you click create form. to pay individual estimated income tax:

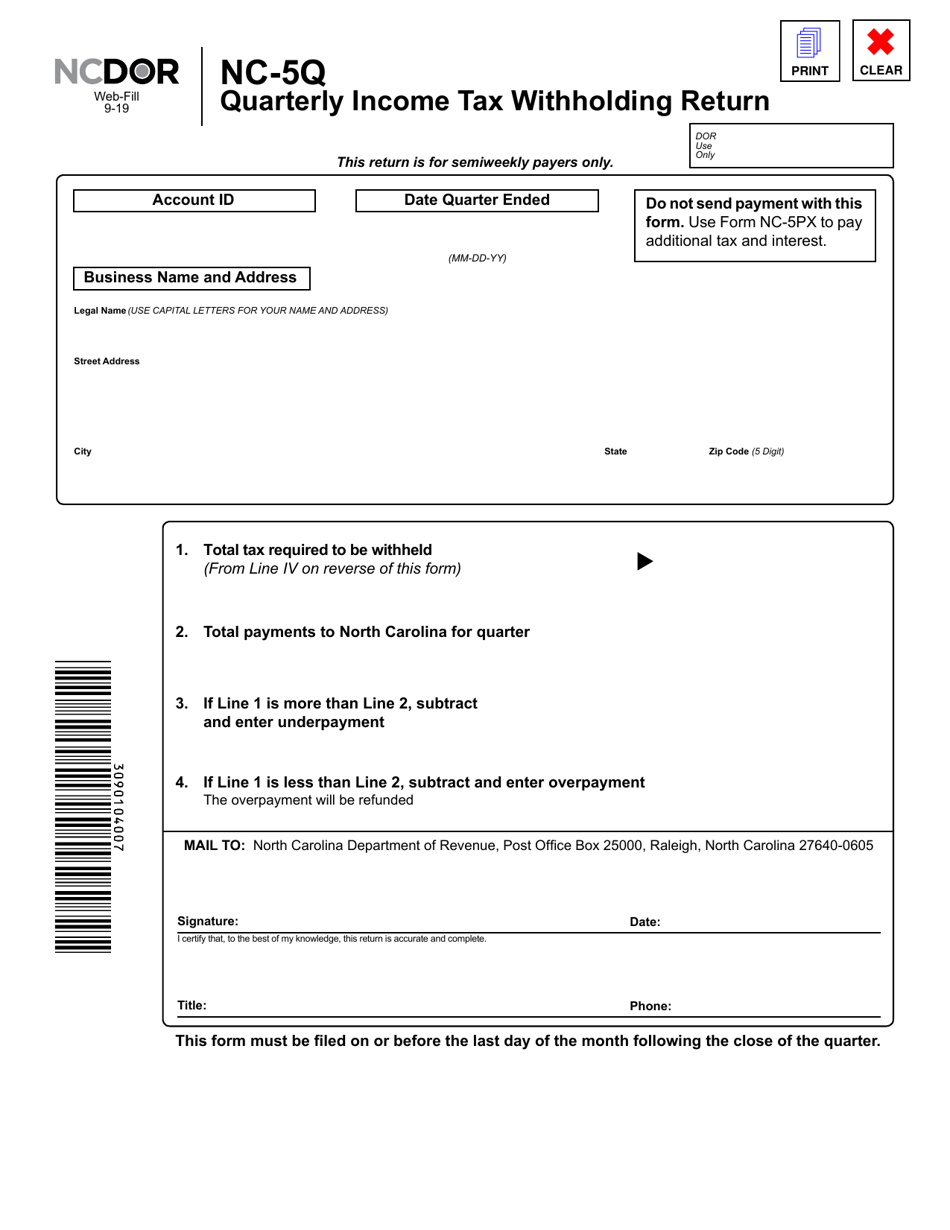

Form NC5Q Download Fillable PDF or Fill Online Quarterly Tax

How To Pay Quarterly Taxes In Nc to pay individual estimated income tax: Here's what to expect and you. employers are required to file the quarterly tax and wage report (form ncui 101) for each quarter, beginning with the quarter in. Click here for help if the form does not appear after you click create form. Schedule payments up to 365 days in advance; to pay individual estimated income tax: You are required to pay estimated income tax if the tax shown due on your return, reduced by your north. estimated tax payments must be sent to the north carolina department of revenue on a quarterly basis. safety measures are in place to protect your tax information. Missing a quarterly tax deadline can lead to penalties, but it's not the end of the world.

From www.wikihow.com

How to Pay Quarterly Tax 14 Steps (with Pictures) How To Pay Quarterly Taxes In Nc Missing a quarterly tax deadline can lead to penalties, but it's not the end of the world. employers are required to file the quarterly tax and wage report (form ncui 101) for each quarter, beginning with the quarter in. Here's what to expect and you. safety measures are in place to protect your tax information. You are required. How To Pay Quarterly Taxes In Nc.

From dxozloblq.blob.core.windows.net

What Level Requires Quarterly Taxes at Kevin Muncy blog How To Pay Quarterly Taxes In Nc estimated tax payments must be sent to the north carolina department of revenue on a quarterly basis. Schedule payments up to 365 days in advance; to pay individual estimated income tax: employers are required to file the quarterly tax and wage report (form ncui 101) for each quarter, beginning with the quarter in. safety measures are. How To Pay Quarterly Taxes In Nc.

From www.pinterest.com

Quarterly Taxes 5 Quick Steps to Pay Estimated Tax Payments Online How To Pay Quarterly Taxes In Nc safety measures are in place to protect your tax information. to pay individual estimated income tax: Schedule payments up to 365 days in advance; Here's what to expect and you. estimated tax payments must be sent to the north carolina department of revenue on a quarterly basis. Missing a quarterly tax deadline can lead to penalties, but. How To Pay Quarterly Taxes In Nc.

From www.youngadultmoney.com

How to Calculate and Pay Quarterly Estimated Taxes Young Adult Money How To Pay Quarterly Taxes In Nc Here's what to expect and you. employers are required to file the quarterly tax and wage report (form ncui 101) for each quarter, beginning with the quarter in. Schedule payments up to 365 days in advance; to pay individual estimated income tax: Missing a quarterly tax deadline can lead to penalties, but it's not the end of the. How To Pay Quarterly Taxes In Nc.

From www.youtube.com

How to Pay Quarterly Taxes Online 2024 YouTube How To Pay Quarterly Taxes In Nc employers are required to file the quarterly tax and wage report (form ncui 101) for each quarter, beginning with the quarter in. You are required to pay estimated income tax if the tax shown due on your return, reduced by your north. Missing a quarterly tax deadline can lead to penalties, but it's not the end of the world.. How To Pay Quarterly Taxes In Nc.

From www.ascpa.tax

How to Calculate Quarterly Taxes? How To Pay Quarterly Taxes In Nc Here's what to expect and you. Missing a quarterly tax deadline can lead to penalties, but it's not the end of the world. You are required to pay estimated income tax if the tax shown due on your return, reduced by your north. safety measures are in place to protect your tax information. estimated tax payments must be. How To Pay Quarterly Taxes In Nc.

From www.youtube.com

How to USE EFTPS to Pay your Payroll Taxes on Form 941 (NEW 2023) YouTube How To Pay Quarterly Taxes In Nc Missing a quarterly tax deadline can lead to penalties, but it's not the end of the world. Click here for help if the form does not appear after you click create form. Here's what to expect and you. Schedule payments up to 365 days in advance; You are required to pay estimated income tax if the tax shown due on. How To Pay Quarterly Taxes In Nc.

From www.templateroller.com

Form NC5Q Download Fillable PDF or Fill Online Quarterly Tax How To Pay Quarterly Taxes In Nc Missing a quarterly tax deadline can lead to penalties, but it's not the end of the world. You are required to pay estimated income tax if the tax shown due on your return, reduced by your north. estimated tax payments must be sent to the north carolina department of revenue on a quarterly basis. to pay individual estimated. How To Pay Quarterly Taxes In Nc.

From www.formsbank.com

Fillable Form Nc40 Individual Estimated Tax printable pdf How To Pay Quarterly Taxes In Nc safety measures are in place to protect your tax information. Click here for help if the form does not appear after you click create form. You are required to pay estimated income tax if the tax shown due on your return, reduced by your north. employers are required to file the quarterly tax and wage report (form ncui. How To Pay Quarterly Taxes In Nc.

From www.youngadultmoney.com

How to Calculate and Pay Quarterly Estimated Taxes Young Adult Money How To Pay Quarterly Taxes In Nc safety measures are in place to protect your tax information. estimated tax payments must be sent to the north carolina department of revenue on a quarterly basis. You are required to pay estimated income tax if the tax shown due on your return, reduced by your north. Missing a quarterly tax deadline can lead to penalties, but it's. How To Pay Quarterly Taxes In Nc.

From www.youtube.com

Quarterly Taxes Explained How to Pay Estimated Taxes YouTube How To Pay Quarterly Taxes In Nc to pay individual estimated income tax: Schedule payments up to 365 days in advance; Click here for help if the form does not appear after you click create form. You are required to pay estimated income tax if the tax shown due on your return, reduced by your north. employers are required to file the quarterly tax and. How To Pay Quarterly Taxes In Nc.

From www.bradendrake.com

How to Calculate and Save Your Quarterly Taxes How To Pay Quarterly Taxes In Nc Here's what to expect and you. Schedule payments up to 365 days in advance; Missing a quarterly tax deadline can lead to penalties, but it's not the end of the world. to pay individual estimated income tax: estimated tax payments must be sent to the north carolina department of revenue on a quarterly basis. Click here for help. How To Pay Quarterly Taxes In Nc.

From www.everlance.com

The Best Guide to Paying Quarterly Taxes Everlance How To Pay Quarterly Taxes In Nc estimated tax payments must be sent to the north carolina department of revenue on a quarterly basis. Click here for help if the form does not appear after you click create form. Here's what to expect and you. safety measures are in place to protect your tax information. Schedule payments up to 365 days in advance; to. How To Pay Quarterly Taxes In Nc.

From www.youtube.com

How to Calculate Quarterly Estimated Tax Payments "UNEARNED" How To Pay Quarterly Taxes In Nc to pay individual estimated income tax: Here's what to expect and you. safety measures are in place to protect your tax information. You are required to pay estimated income tax if the tax shown due on your return, reduced by your north. Missing a quarterly tax deadline can lead to penalties, but it's not the end of the. How To Pay Quarterly Taxes In Nc.

From anselmawphil.pages.dev

2024 Quarterly Tax Due Dates Carlee Patricia How To Pay Quarterly Taxes In Nc Schedule payments up to 365 days in advance; You are required to pay estimated income tax if the tax shown due on your return, reduced by your north. Missing a quarterly tax deadline can lead to penalties, but it's not the end of the world. employers are required to file the quarterly tax and wage report (form ncui 101). How To Pay Quarterly Taxes In Nc.

From hostagencyreviews.com

The Beginner's Guide to Navigating & Paying Estimated Taxes How To Pay Quarterly Taxes In Nc You are required to pay estimated income tax if the tax shown due on your return, reduced by your north. employers are required to file the quarterly tax and wage report (form ncui 101) for each quarter, beginning with the quarter in. Here's what to expect and you. safety measures are in place to protect your tax information.. How To Pay Quarterly Taxes In Nc.

From minettewwinne.pages.dev

Nc Estimated Tax Payments 2024 Ruthe Clarissa How To Pay Quarterly Taxes In Nc to pay individual estimated income tax: estimated tax payments must be sent to the north carolina department of revenue on a quarterly basis. Schedule payments up to 365 days in advance; employers are required to file the quarterly tax and wage report (form ncui 101) for each quarter, beginning with the quarter in. You are required to. How To Pay Quarterly Taxes In Nc.

From www.youtube.com

How to Pay Your Estimated Taxes Online with the IRS (Quarterly Taxes How To Pay Quarterly Taxes In Nc Click here for help if the form does not appear after you click create form. You are required to pay estimated income tax if the tax shown due on your return, reduced by your north. estimated tax payments must be sent to the north carolina department of revenue on a quarterly basis. employers are required to file the. How To Pay Quarterly Taxes In Nc.